Measure Would Eliminate Tax On Used Car Sales Under $10K

On Thursday lawmakers filed a measure to reduce taxes on used cars in Arkansas.

H.B. 1431 by Rep. Robin Lundstrum (R – Springdale) and Sen. Jason Rapert (R – Conway) eliminates the sales tax on used cars sold for less than $10,000.

The bill is similar to H.B. 1160 by Rep. Payton and Sen. Rapert.

H.B. 1431 and H.B. 1160 both are really good bills.

The used car tax hurts Arkansas’ poor and middle class families.

Many Arkansans can barely afford to buy a used car. They can’t afford to pay taxes on top of that.

Single moms who need a reliable vehicle shouldn’t be penalized for buying a used car. H.B. 1431 and H.B. 1160 give families some relief.

This is commonsense legislation that’s going to help a lot of families, and it won’t cost the State very much in tax revenue.

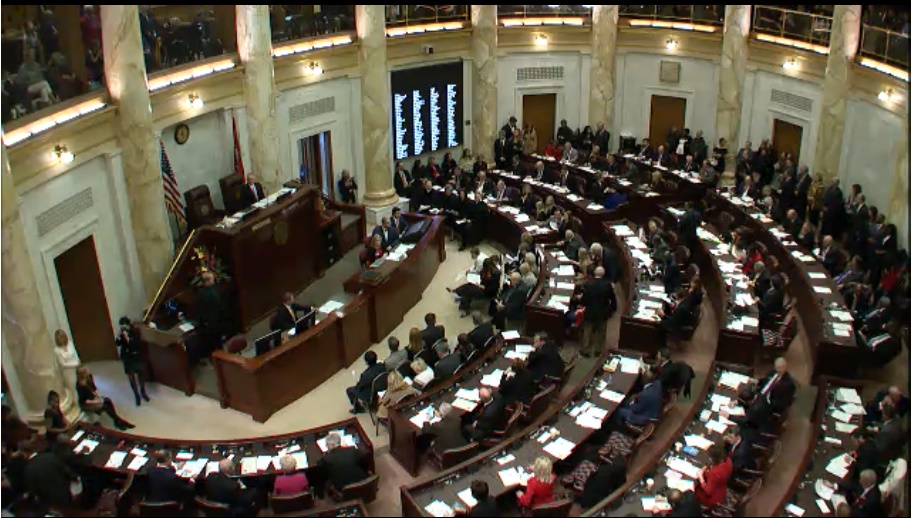

This morning the Arkansas Tax Reform and Relief Task Force met at the Capitol in Little Rock.

This morning the Arkansas Tax Reform and Relief Task Force met at the Capitol in Little Rock.

This week the Tax Reform and Relief Legislative Task Force met in Little Rock to discuss sales tax policies in Arkansas. The task force is reviewing possible changes to the state’s tax structure — including changes to tax exemptions in Arkansas.

This week the Tax Reform and Relief Legislative Task Force met in Little Rock to discuss sales tax policies in Arkansas. The task force is reviewing possible changes to the state’s tax structure — including changes to tax exemptions in Arkansas.