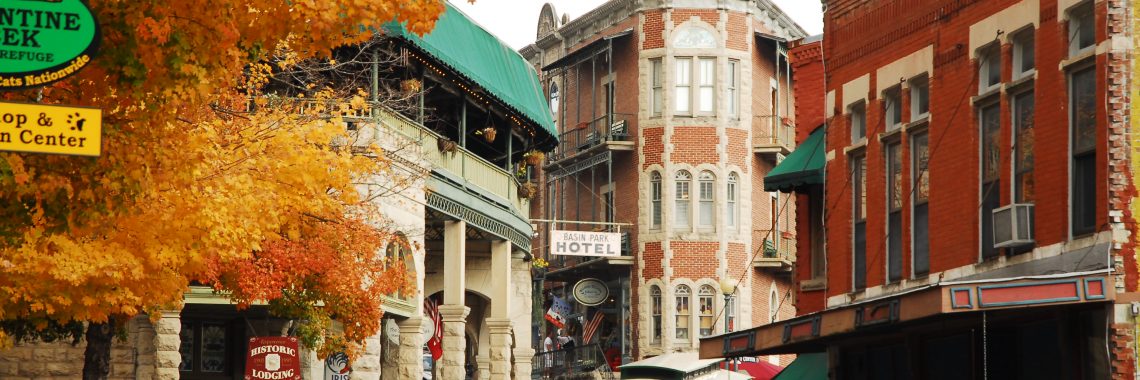

Eureka Springs City Council Approves “Semi-Permanent” Public Drinking District

According to the Arkansas Democrat-Gazette, the Eureka Springs City Council voted 4-2 last week to allow public drinking downtown at certain times of the week.

Act 812 of 2019 by Sen. Trent Garner (R – El Dorado) and Rep. Sonia Barker (R – Smackover) lets cities create “entertainment districts” where alcohol can be carried and consumed publicly on streets and sidewalks.

The Eureka Springs ordinance creating a public drinking district will expire in September — giving the city council an opportunity to revisit the issue.

As we have said before, public drinking is a scourge on the community.

It raises serious concerns about drunk driving and public safety.

Public drinking doesn’t attract new businesses or bolster the economy.

It hurts neighborhoods and families.

That’s why Family Council has put together a free toolkit to help citizens oppose these public drinking districts.

Our toolkit contains talking points, information about problems public drinking has caused in other states, photographs of public drinking districts elsewhere around the country, and other resources you can use to fight public drinking in your community.

Click here to download our free toolkit.

Photo by Photolitherland at English Wikipedia [CC BY 3.0 (https://creativecommons.org/licenses/by/3.0)]