Task Force Plans to Review Grocery Tax Increase

Yesterday we wrote that the legislature’s Tax Reform and Relief Task Force met to discuss proposals to raise the state sales tax on groceries; eliminate the annual sales tax holiday for back-to-school supplies; levy a sales tax on nonprofit hospitals and nursing homes; and cut taxes on new and used cars.

Yesterday we wrote that the legislature’s Tax Reform and Relief Task Force met to discuss proposals to raise the state sales tax on groceries; eliminate the annual sales tax holiday for back-to-school supplies; levy a sales tax on nonprofit hospitals and nursing homes; and cut taxes on new and used cars.

Bad News From the Task Force Meeting

The Arkansas Democrat-Gazette reports the task force voted to further review plans to increase the state grocery tax.

Under the proposal, the legislature would increase the state sales tax on groceries from 1.5% to 6.5% and create an earned income tax credit that would help offset the effect the grocery tax would have low- and moderate-income families.

The task force cannot raise the grocery tax itself, but it can develop a plan to raise the tax and make recommendations to the legislature in 2019.

The task force also agreed to further study a proposal that would eliminate the back-to-school sales tax holiday. That’s bad news.

Good News From the Task Force Meeting

Lawmakers opted to continue reviewing plans to exempt vehicles sold for less than $10,000 from the state sale tax, and decided not to move forward with a proposal to tax sales to nonprofit and charitable hospitals and nursing homes. That’s good news.

The Bottom Line

I’m glad legislators might cut taxes on new and used cars, but it’s troubling that some elected officials want to raise taxes on basic necessities like groceries.

Lawmakers have indicated their goal is to reduce income taxes for top earners as well as low-income families. To do this, some say they need to overhaul — and increase — Arkansas’ sales taxes.

If Arkansas raises taxes on groceries while giving income tax breaks to the poor and the wealthy, that’s going to hurt middle class families who don’t qualify for any tax credits. No one should be penalized for buying bread and milk.

Likewise, eliminating the back-to-school sales tax holiday affects parents with young children. The tax holiday doesn’t exist to help businesses. It’s meant to help families. The tax holiday makes it easier to purchase basic supplies for educating students.

Legislators need to think very carefully before taking up proposals to eliminate the tax breaks or raise taxes on everyday families.

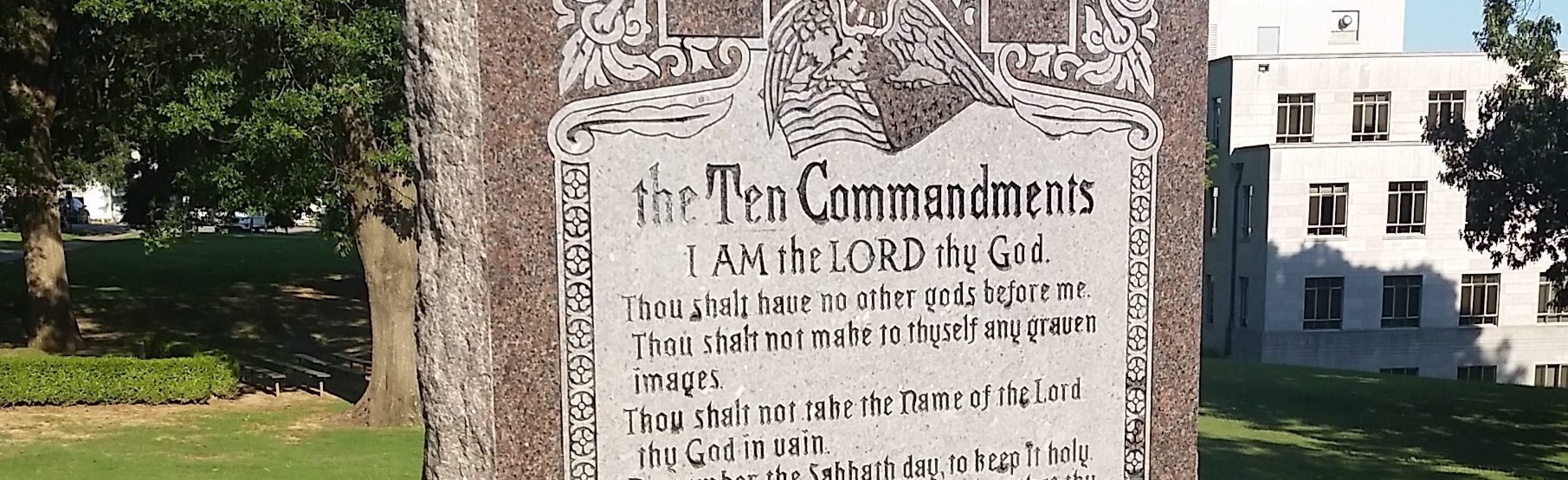

You and your family are invited to come see Arkansas’ monument of the Ten Commandments unveiled and dedicated at a brief ceremony tomorrow at 11:30 AM on the lawn outside the Arkansas Capitol Building in Little Rock.

You and your family are invited to come see Arkansas’ monument of the Ten Commandments unveiled and dedicated at a brief ceremony tomorrow at 11:30 AM on the lawn outside the Arkansas Capitol Building in Little Rock.

On Wednesday morning the Arkansas Tax Reform and Relief Legislative Task Force met to review proposed changes to the state’s sales tax exemptions.

On Wednesday morning the Arkansas Tax Reform and Relief Legislative Task Force met to review proposed changes to the state’s sales tax exemptions.