Judge Rules Against State on Marijuana Farms

In February the Medical Marijuana Commission announced five companies authorized to grow marijuana in Arkansas. However, this week a judge said the process commissioners followed to pick those companies did not comply with the law.

In February the Medical Marijuana Commission announced five companies authorized to grow marijuana in Arkansas. However, this week a judge said the process commissioners followed to pick those companies did not comply with the law.

The Arkansas Democrat-Gazette writes,

In a 28-page decision, Judge Wendell Griffen issued a preliminary injunction barring the Arkansas Medical Marijuana Commission from issuing five cannabis-growing licenses. The injunction is a continuance of a temporary restraining order Griffen issued a week ago, just hours before the commission planned to formally award the licenses to five companies.

Wednesday’s order, however, went a step further, declaring the commission’s rankings of the 95 growing license applications “null and void.”

The Medical Marijuana Commission reviewed and ranked applications to grow marijuana; the five highest-ranked applicants received cultivation licenses.

In his decision, Judge Griffen wrote that the process defied due process and the rule of law.

You can read more about this story here.

Photo By Cannabis Training University (Own work) [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons.

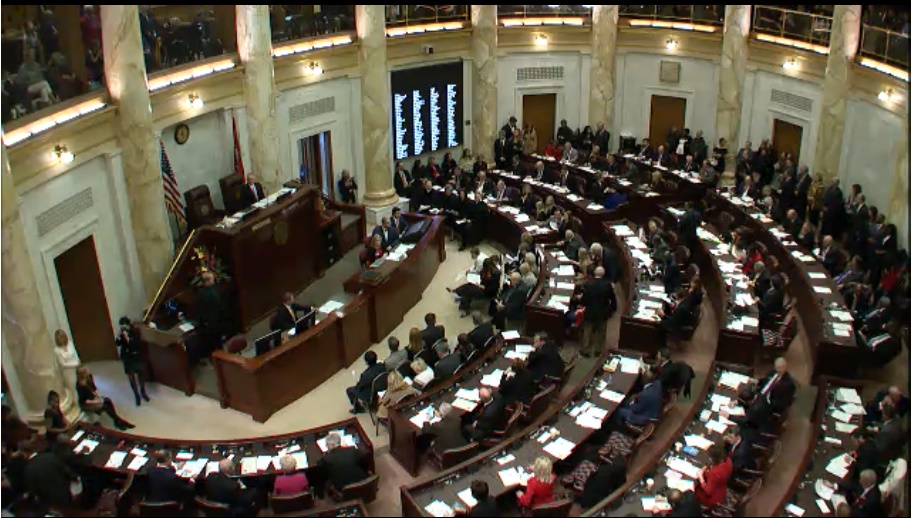

This week the Tax Reform and Relief Legislative Task Force met in Little Rock to discuss sales tax policies in Arkansas. The task force is reviewing possible changes to the state’s tax structure — including changes to tax exemptions in Arkansas.

This week the Tax Reform and Relief Legislative Task Force met in Little Rock to discuss sales tax policies in Arkansas. The task force is reviewing possible changes to the state’s tax structure — including changes to tax exemptions in Arkansas.

The State of Washington recently moved to legalize commercial surrogacy, allowing people to pay women to bear children for them.

The State of Washington recently moved to legalize commercial surrogacy, allowing people to pay women to bear children for them.